Are you looking to stay on top of your loan payments? Calculating your loan amortization schedule can help you plan your finances better. With a printable loan amortization schedule calculator, you can easily track how much you owe and when it’s due.

Understanding how your loan payments are structured can give you a clear picture of how much you’ll be paying each month and how much of that goes towards the principal and interest. This information can help you budget and manage your finances effectively.

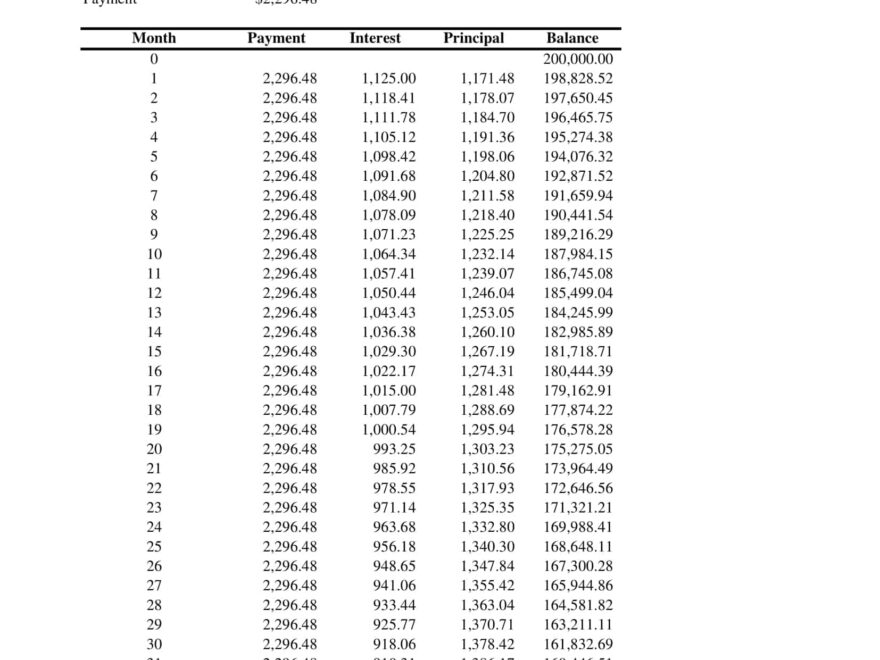

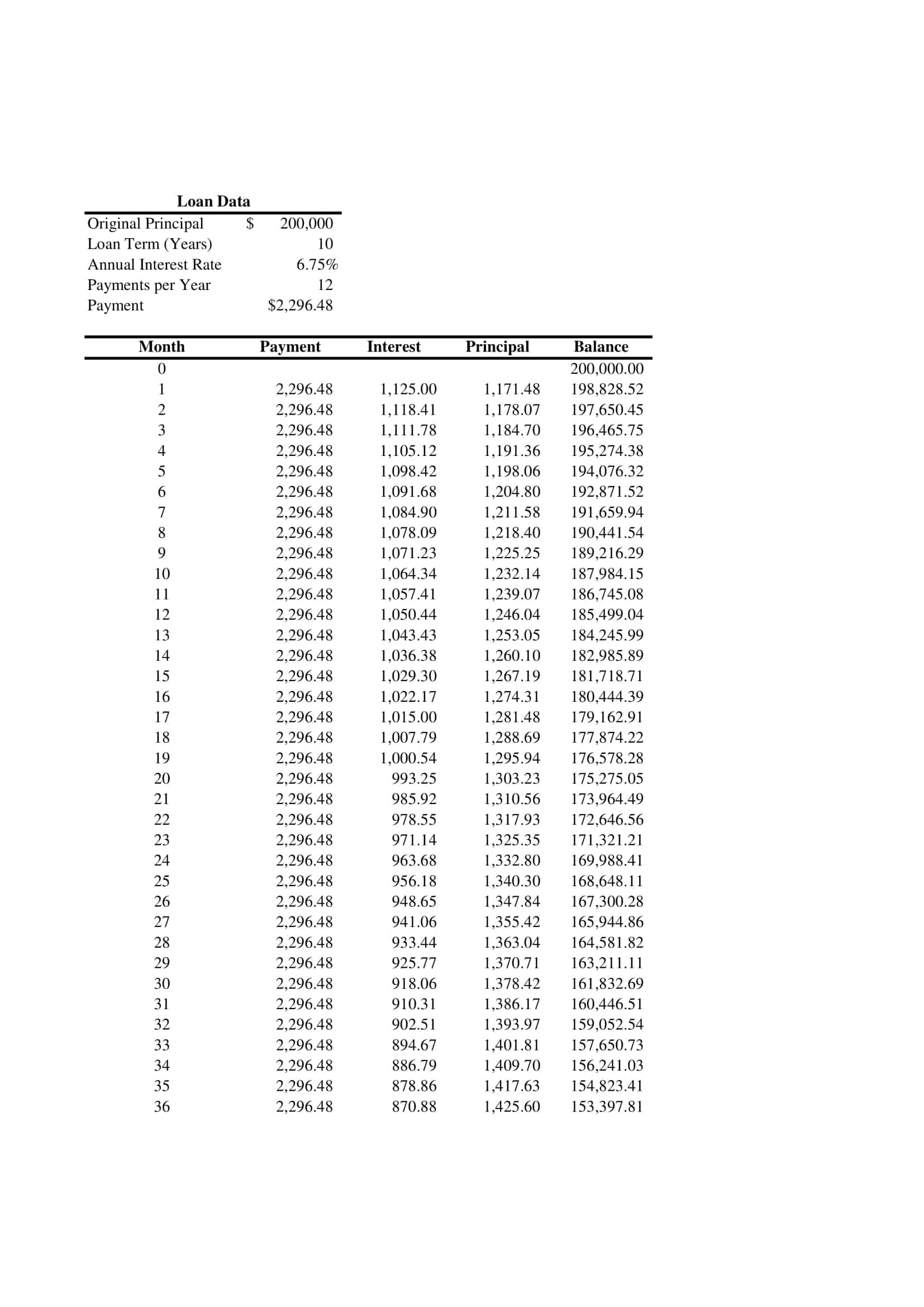

Loan Amortiztion Schedule Calculator Printable

Loan Amortiztion Schedule Calculator Printable

Using a loan amortization schedule calculator can be a game-changer when it comes to managing your loans. Simply input the loan amount, interest rate, and term, and the calculator will generate a schedule showing you how much you owe each month.

With a printable loan amortization schedule, you can easily keep track of your payments and see how they change over time. This can be especially helpful if you’re considering making extra payments to pay off your loan faster.

By having a visual representation of your loan payments, you can stay motivated to stick to your repayment plan and see the light at the end of the tunnel. Knowing exactly how much you owe and when it’s due can give you peace of mind and help you stay on top of your financial goals.

So, if you’re looking to take control of your finances and stay organized with your loan payments, consider using a loan amortization schedule calculator. With just a few clicks, you can have a printable schedule that will keep you on track to financial success.

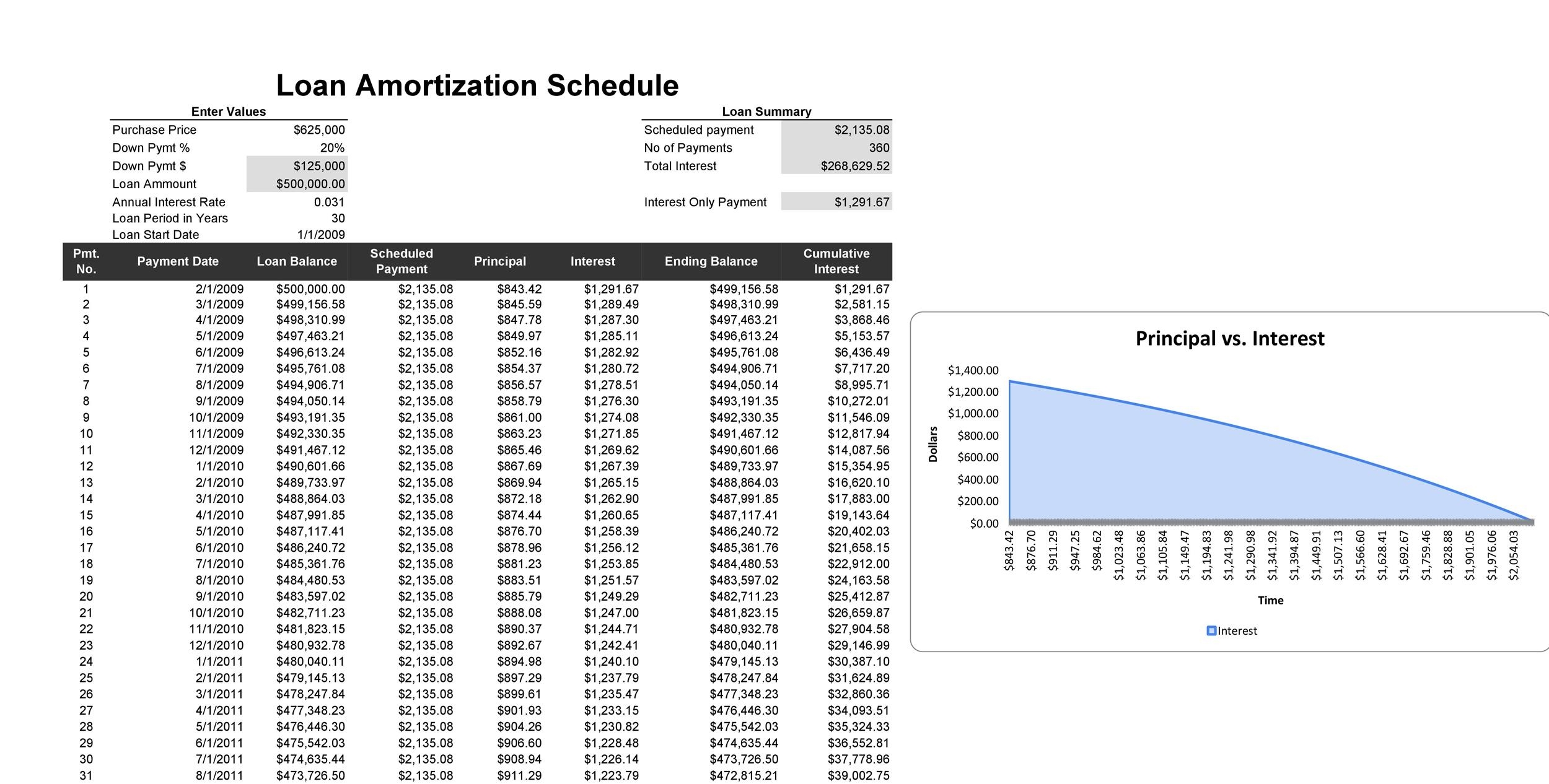

Free Excel Amortization Schedule Templates Smartsheet

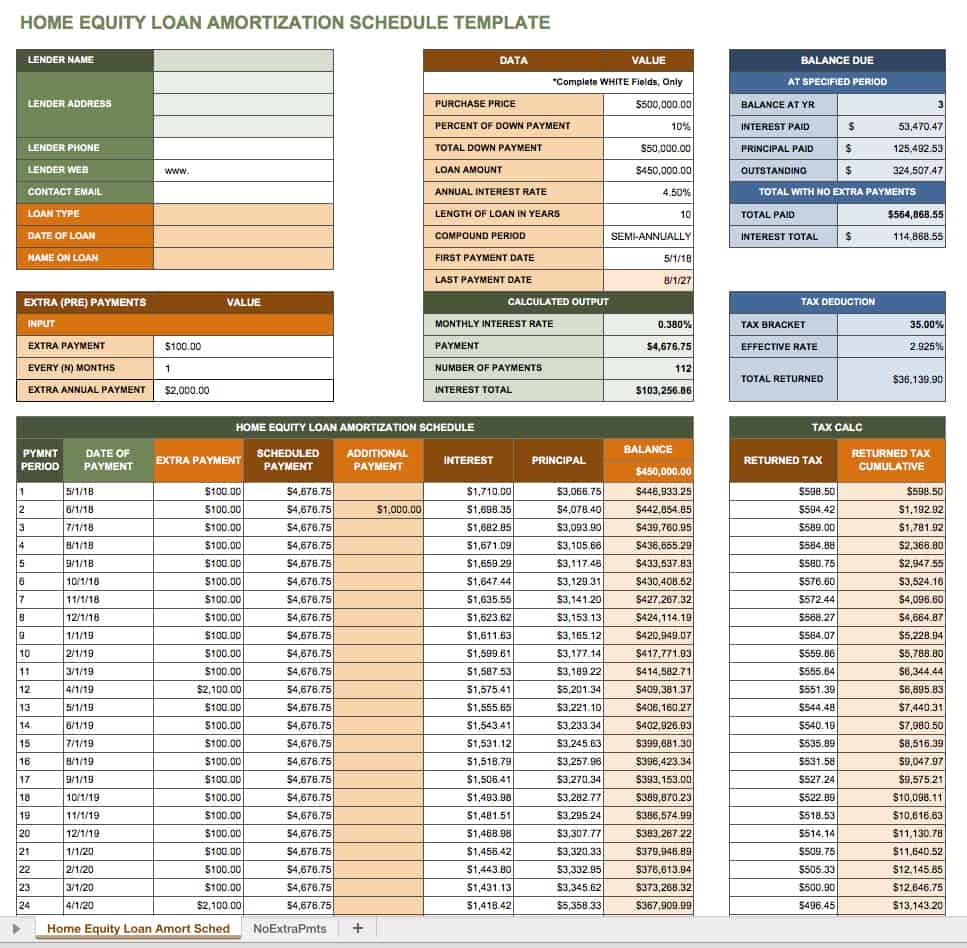

Free Printable Amortization Schedule Templates PDF Excel